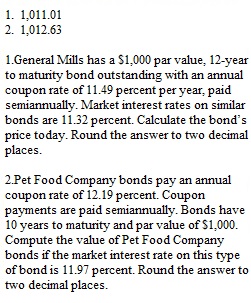

Q 1.General Mills has a $1,000 par value, 12-year to maturity bond outstanding with an annual coupon rate of 11.49 percent per year, paid semiannually. Market interest rates on similar bonds are 11.32 percent. Calculate the bond’s price today. Round the answer to two decimal places. 2.Pet Food Company bonds pay an annual coupon rate of 12.19 percent. Coupon payments are paid semiannually. Bonds have 10 years to maturity and par value of $1,000. Compute the value of Pet Food Company bonds if the market interest rate on this type of bond is 11.97 percent. Round the answer to two decimal places. 3.Flower Valley Company bonds have a 12.92 percent coupon rate. Interest is paid semiannually. The bonds have a par value of $1,000 and will mature 25 years from now. Compute the value of Flower Valley Company bonds if investors’ required rate of return is 10.17 percent. Round the answer to two decimal places.

View Related Questions